ATTENTION: tech investors

Wall Street's AI Revolution: Why Most Retail Investors Are Playing It Wrong

Recent institutional ownership data for NVIDIA reveals a telling pattern that most retail investors are missing. While institutions maintain dominant control of 66% of NVIDIA's shares, a significant shift is occurring beneath the surface.

sponsor

He turned PayPal from a tiny, off-the-radar startup… to a massive $64 billion giant. Then, he did it again with Tesla… which is up more than 19,500% since 2010. And now, Elon could be set to do it for the third and final time… with what might be his biggest breakthrough yet. And for the first time ever, you have the rare chance to profit BEFORE the upcoming IPO. Click here now for the urgent details on this hidden play.

Over the past 12 months, the numbers tell a compelling story: 3,628 institutional buyers have invested $267.46 billion, while 2,040 institutional sellers have taken profits with outflows of $8.54 billion. This level of institutional movement points to a calculated repositioning by Wall Street's smartest money.

The Vanguard Group remains the largest institutional shareholder with 8.7% ownership, but the broader institutional landscape shows active position management rather than simple buy-and-hold strategies. This matters because institutional investors, with their vast resources and research capabilities, often signal market directions months before they become obvious to retail investors.

For retail investors, understanding this institutional movement is crucial. While NVIDIA remains a cornerstone of the AI revolution, the significant institutional selling alongside continued buying suggests sophisticated investors are carefully rebalancing their exposure to the sector.

The pattern emerging from institutional trading data indicates that the next phase of AI investing may require a more nuanced approach than simply buying market leaders. With no dominant shareholder and shares widely distributed, institutional moves can significantly impact stock performance.

[Note: For an in-depth analysis of institutional movements in AI stocks and emerging opportunities, watch the presentation below.]

did the article make sense? if so...

You Need To Watch This Next

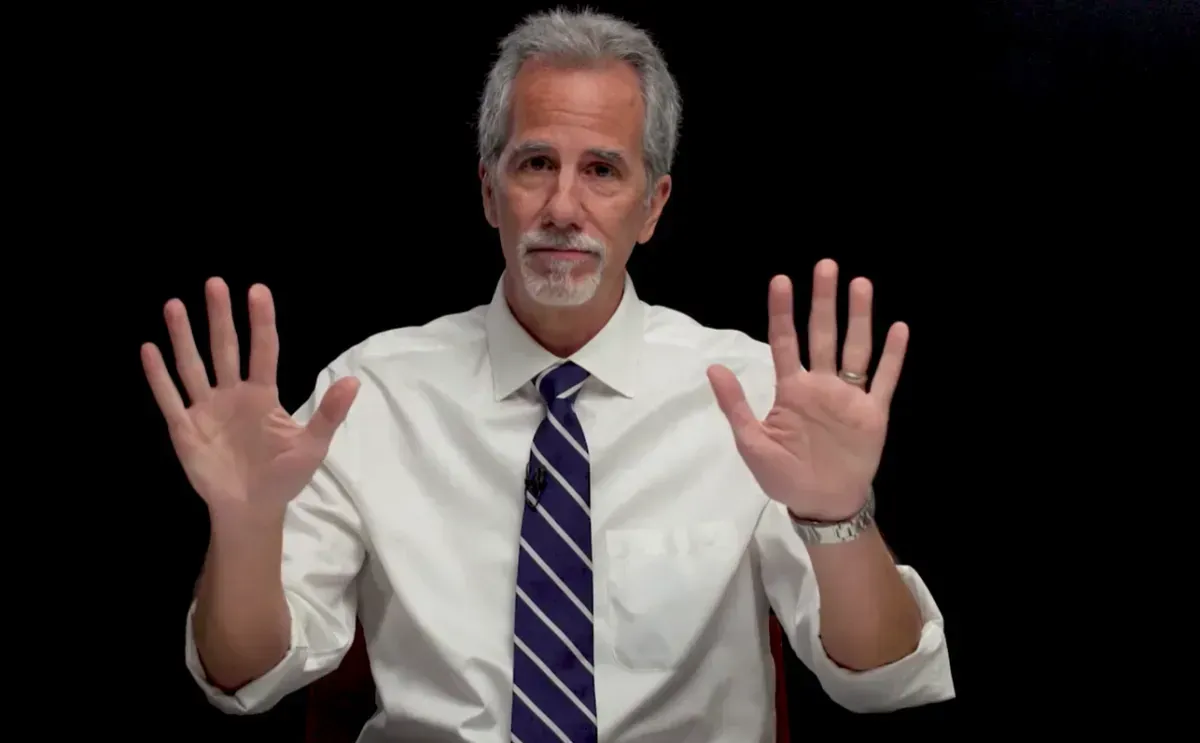

He called the 2020 crash, the 2022 bear market, and the 2023 bank run. Now, as Wall Street billionaires quietly sell their shares, he’s stepping forward with a critical NVDA update – and the #1 stock you should buy today instead.

TRENDING STORIES

Washington's reckless spending is ruining the economy, destroying the dollar and robbing your retirement savings.

But you don't have to sit by and take it...Thanks to a little-known "IRS loophole," you can shift savings into the safety of gold without penalties or taxes taken.If you absolutely REFUSE to let greedy politicians ruin your retirement...Get your

FREE 2024 Gold Guide and discover how to secure your savings and avoid a retirement shortfall while you still can.

There is nothing the Federal Reserve can do to stop what's coming next for U.S. stocks. As you've seen yourself with all this recent volatility...The wheels are falling off the United States stock market.

If you think a simple rate cut can "solve" this...

When the Government Releases Certain Data, Either Good or Bad...

You Can Target Up to +383% Overnight (See the Proof!)

New Trade Goes LIVE THIS TUESDAY at 2 pm

Disclaimer for MyInvestorNewsAndReports.com

MyInvestorNewsAndReports.com, a brand under Market Insiders Media dba, operates under the parent company Sandpiper Marketing Group, LLC. Please be advised that MyInvestorNewsAndReports.com is not registered as an investment adviser or broker-dealer with the United States Securities and Exchange Commission or any state regulatory agency. We rely on the "publisher's exclusion" from the definition of investment adviser as set forth in Section 202(a)(11) of the Investment Advisers Act of 1940, as amended, as well as corresponding state securities laws. Consequently, MyInvestorNewsAndReports.com does not offer or provide personalized investment advice.

The information we provide is based on our opinions, statistical and financial data, and independent research of public information. Our materials are intended for informational purposes only, and no mention of a specific security in any of our content constitutes a recommendation to buy, sell, or hold that or any other security. Any information deemed to be investment opinion is impersonal and not tailored to the investment needs of any individual.

Please be aware that MyInvestorNewsAndReports.com does not promise, guarantee, or imply that any information provided through our websites, newsletters, reports, or printed material will result in profit or loss. We strongly encourage you to seek personal advice from your professional investment, tax, or legal advisors and to conduct your own due diligence and independent investigations before acting on any information we publish or making any investment decision. Only you and your professional advisors can determine the level of risk appropriate for you. Penny stocks, in particular, are inherently speculative investments, and you should be prepared to lose your entire investment.

Employees, owners, and/or writers of MyInvestorNewsAndReports.com may own positions in the equities, options, and/or securities mentioned in our content. However, no associated employees will intentionally engage in any transaction that directly or indirectly competes with the interests of our subscribers. MyInvestorNewsAndReports.com may be compensated for publishing information about companies referred to in our reports, newsletters, and websites, and we provide full disclosure of such compensation.

Furthermore, please note that any content marked as "Sponsor" may be paid for and is not endorsed or warranted by our staff or company. Specifically, we are compensated five dollars per click by i2i LLC for clicking on the ad for AUST Mining Company. The content in our emails is for educational or entertainment use and is not a substitute for professional advice or an offer to buy or sell any securities. Neither the publisher nor the editors are registered investment advisors (RIA’s) and do not provide personalized counseling. Be sure to conduct your own careful research and consult with your advisors before taking any action based on our content. By opening our emails or clicking any links contained therein, you are reconfirming your opt-in status, which is part of your free subscription.